Date: Dec 2025

Deciding how much you can safely withdraw each year in your retirement is one of the most significant financial decisions you will make. Building a sizeable portfolio is only one aspect of retirement planning; another is ensuring your wealth continues to serve your lifestyle while guarding against unforeseen market swings. Withdraw too much and you risk running out of money; withdraw too little and you may unnecessarily reduce your quality of life.

Over the past decade, equities have delivered healthy long-term returns in India; however, the sequence-of-returns, risk and inflation can significantly impact retirement outcomes. A comfortable withdrawal ensures that you maintain your lifestyle goals without depleting capital during market stress. Portfolio growth is influenced by more than headline market returns or GDP growth. Although India’s nominal GDP has often been robust, equity and fixed income returns depend on corporate performance, valuations, and global flows. Prudent withdrawal planning uses historical performance as a guide rather than a guarantee.

Source: RBI (Data as on Nov-25)

The Trinity Study is one of the most widely cited research studies on retirement withdrawals, particularly in the

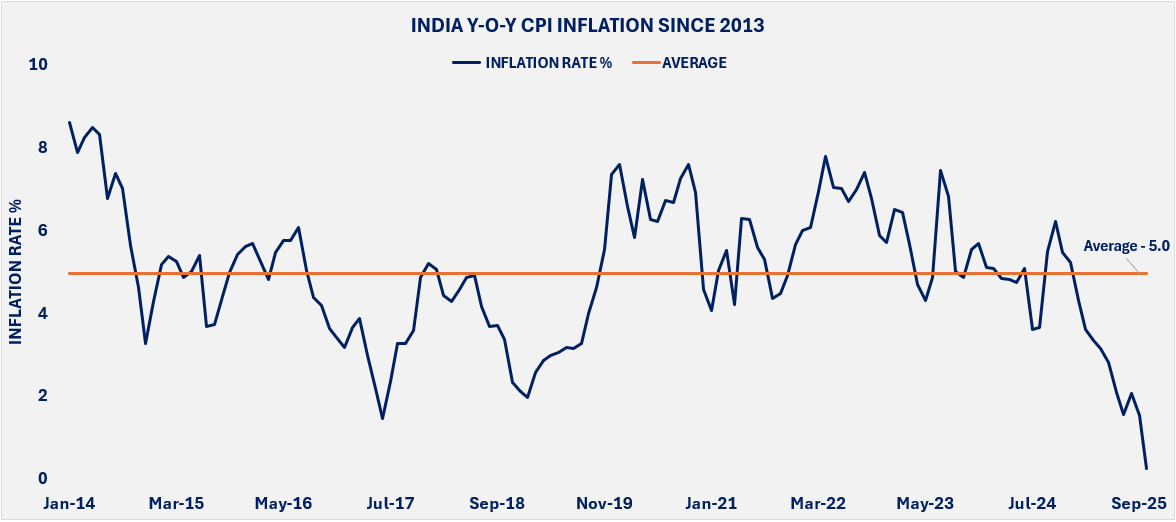

U.S. context, and it serves as the foundation for what’s popularly known as the “4% rule.” The study reveals that a 4% withdrawal in the first year, then adjusting for inflation, allows the portfolio to last through a 30-year retirement horizon. While developed in the U.S., its principles are applicable globally, including India, as they emphasize the importance of balancing withdrawals with long-term portfolio growth. It is important to keep in mind that emerging markets such as India have a higher inflation rate – the average CPI inflation in India has been 5% since 2013. Hence, the 4% rule can be tweaked for local market conditions and possibly adopting more conservative withdrawal rates between 3% and 3.5%.

Even a well-chosen withdrawal rate can falter if markets underperform early in retirement. Guyton-Klinger guardrails can be beneficial in this scenario. Based on the performance of the portfolio, the approach adjusts withdrawals according to predetermined levels. If the portfolio performs well and the withdrawal rate falls below a lower threshold, withdrawals can be increased by a set percentage. Conversely, if the portfolio underperforms and the withdrawal rate rises above a threshold, withdrawals are reduced by a set percentage to preserve capital. Guardrails provide high-net-worth clients structured flexibility, ensuring withdrawals remain sustainable without compromising lifestyle during periods of market turbulence.

At Privus, we follow a bucket strategy during retirement or early portfolio withdrawals. A “Safety bucket” that holds expenses for the next 2-3 years, invested in debt instruments or short-term bonds, providing a buffer against market volatility. A “Growth bucket” where the remaining capital remains allocated to equities and other growth assets. We believe 3-year period is sufficient for equities to converge to their long-term averages (Outperform – if invested at right valuations), enabling withdrawals from the safety bucket without forced selling during market downturns. This approach allows equity investments to withstand short-term volatility.

| NIFTY 50 TRI | 1YR | 3YR | 5YR |

|---|---|---|---|

| Average Return | 16% | 15% | 15% |

| Volatility | 26% | 12% | 9% |

| % of times returns were < 0% | 23% | 6% | 0% |

Source: NSE (Data as on 31st October 2025; Rolling returns since 1999)

Final thoughts – comfortable is personal, not purely mathematical. Market returns in India over the last decade-plus have been attractive, which tempts retirees to withdraw more. But sequence risk, inflation, taxes, and unpredictable health/life events matter more than average returns. Therefore, global professional practice, balances an initial safe withdrawal percentage (often 4%-5% for prudence), a defined spending rule that adapts to outcomes (guardrails/dynamic rules), and structural safeguards (buckets, annuities) to protect the essentials.

DISCLAIMER: This report/presentation is intended for the personal and private use of the recipient and is for private circulation only. It is not to be published, reproduced, distributed, or disclosed, whether wholly or in part, to any other person or entity without prior written consent. The report/presentation has been prepared by Privus Advisors (Firm) based on the information available in public domain & other external sources which are beyond Privus’ control and may also include the Firm’s personal views. Though the recipient recognizes such information to be generally reliable, the recipient acknowledges that inaccuracies may occur & that the Firm does not warrant the accuracy or suitability of the information. Neither does the information nor any opinion expressed constitute a legal opinion or an offer, or an invitation to make an offer, to buy or sell any financial or other products / services or securities or any kind of derivatives related to such securities. Any information contained herein relating to taxation is based on the information available in the public domain that may be subject to change. Investors/Clients should refer to relevant foreign exchange regulations / taxation / financial advice as applicable in India and/or abroad about the appropriateness and relevance / impact of the views or suggestions expressed herein, related to any Investment/Estate Planning / Succession Planning. All investments are subject to market risks, read all related documents carefully before investing. The Firm is registered with SEBI as a non-individual RIA bearing Reg. No. INA000019752 & BSEASL membership No. 2230. Registration granted by SEBI, membership of BASL and certification of National Institute of Securities Markets (NISM) in no way guarantees performance of the intermediary or provide any assurance of returns to investors.