Date: Sep 2025

Index funds have transformed the investment landscape. They are low-cost, diversified, transparent, and designed to match the performance of a market index making them an attractive choice for both new and seasoned investors. With the rise of digital platforms, anyone can access index products with a few clicks. This has led to a common question: “If I’m investing in index funds, do I really need an advisor?”

Our answer: Absolutely, especially if you want your portfolio to work in harmony with your personal goals, life stage, and risk profile.

An index fund’s objective is straightforward: track an index like the NIFTY 50 or the S&P 500. But successful investing isn’t just about buying a product; it’s about constructing and maintaining a plan. How much of your portfolio should be in equity index funds versus bonds, gold, or alternative assets? This depends on your time horizon, cash flow needs, and future liabilities.

For high-net-worth individuals, index investing must be woven into a strategy that considers estate planning, tax optimisation, and intergenerational wealth transfer. Without guidance, investors risk building an index portfolio that’s technically diversified but misaligned with their financial blueprint.

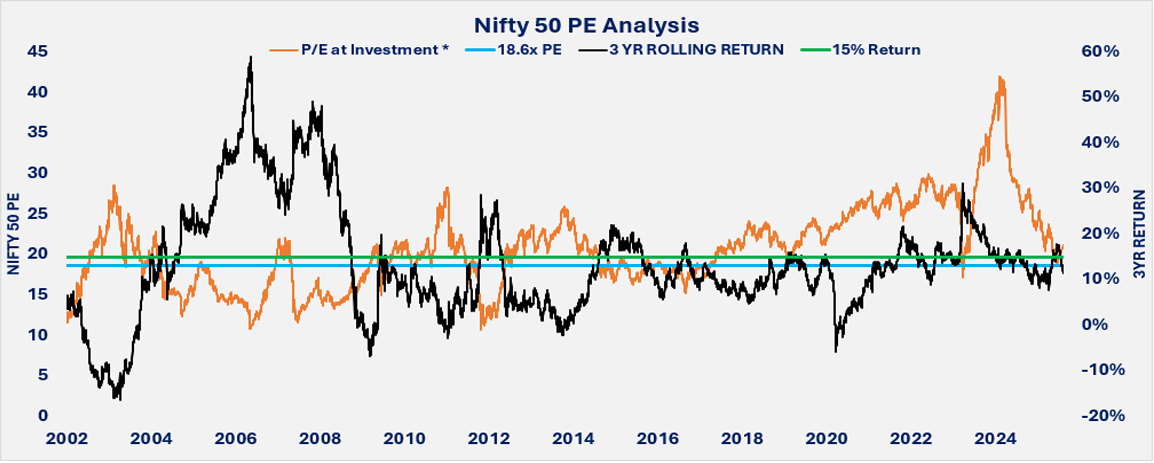

Many assume index investing means “set it and forget it.” But the timing and valuation of your entry points can have a significant impact on long-term returns. Buying into an index at stretched valuations (e.g., high P/E levels) has historically led to lower forward returns over the next 3–5 years. Advisors can provide discipline helping you avoid emotionally driven lump-sum investments at market peaks and instead use strategies like staggered entries or rebalancing.

After analysing daily 3-year rolling returns taking index data since 1996, we observed that the average 3-year return achieved by Nifty 50 Index is 12%. However, there is approximately a 34% probability of making greater than 15% when entering the market at favourable valuations. Additionally, investors can achieve these returns when buying the index at an average PE of around 19x. While there is the advantage of higher returns, probability of negative returns declines from 9% to around 1%.

Source: NSE (Data as on 10th August 2025) (Data Since 2003) (Sample Size: 8623, Frequency: 3 years daily rolling returns)

* The graph 3-year returns are calculated since 2002 as PE data for Nifty 50 is only available since 1st January 1999

Over the past 20 years, the NIFTY 50 has grown at nearly 13% per year. However, there are investors that achieved returns around 8–9%. Not because the index failed – but because investors buy high, sell low, and let emotions drive decisions. Market crashes trigger panic-selling; bull runs tempt overconfidence. And this happens just as easily in index funds as in stock-picking. An advisor isn’t just there to pick funds – they’re there to stop you from becoming the biggest threat to your own portfolio. Advisors serve as a behavioural anchor, keeping clients committed to their plan during volatility.

Index funds offer diversification and tax efficiency, but hidden sector concentrations and market downturns can increase risks. Advisors help investors balance concentration risk, align asset allocation with their risk profile and time horizon, and ensure sufficient liquidity to avoid forced selling. They also optimise tax strategies like capital gains harvesting and withdrawal sequencing, especially for long-term and high-net-worth investors. By continuously monitoring life changes, market shifts, and tax rules, advisors keep index-based portfolios aligned with financial goals.

At Privus Advisors, we combine the efficiency of index products with disciplined strategy, valuation insight, and bespoke planning and transforming a “good” investment approach into a great wealth-building journey. Index funds are a great tool – but without a plan, they’re just a tool. We make them part of a strategy.

DISCLAIMER: This report/presentation is intended for the personal and private use of the recipient and is for private circulation only. It is not to be published, reproduced, distributed, or disclosed, whether wholly or in part, to any other person or entity without prior written consent. The report/presentation has been prepared by Privus Advisors (Firm) based on the information available in public domain & other external sources which are beyond Privus’ control and may also include the Firm’s personal views. Though the recipient recognizes such information to be generally reliable, the recipient acknowledges that inaccuracies may occur & that the Firm does not warrant the accuracy or suitability of the information. Neither does the information nor any opinion expressed constitute a legal opinion or an offer, or an invitation to make an offer, to buy or sell any financial or other products / services or securities or any kind of derivatives related to such securities. Any information contained herein relating to taxation is based on the information available in the public domain that may be subject to change. Investors/Clients should refer to relevant foreign exchange regulations / taxation / financial advice as applicable in India and/or abroad about the appropriateness and relevance / impact of the views or suggestions expressed herein, related to any Investment/Estate Planning / Succession Planning. All investments are subject to market risks, read all related documents carefully before investing. The Firm is registered with SEBI as a non-individual RIA bearing Reg. No. INA000019752 & BSEASL membership No. 2230. Registration granted by SEBI, membership of BASL and certification of National Institute of Securities Markets (NISM) in no way guarantees performance of the intermediary or provide any assurance of returns to investors.