More isn’t better: The Real Meaning of Diversification

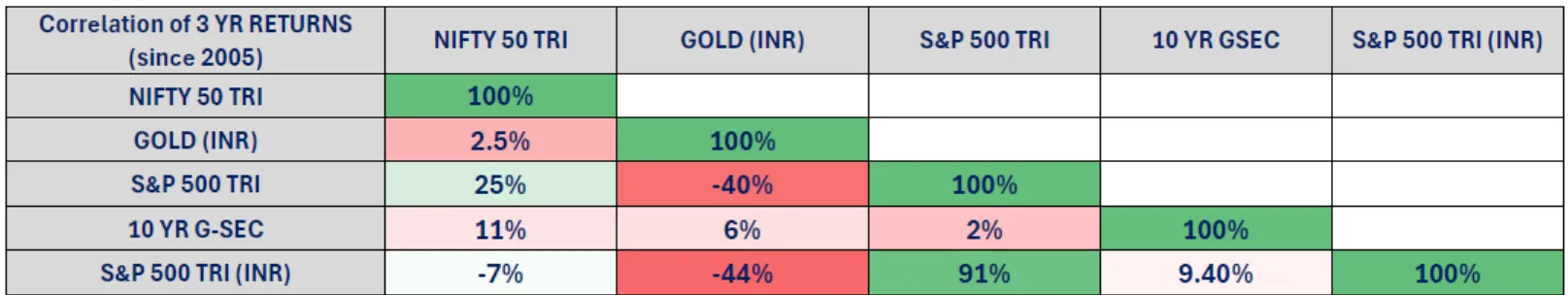

In today’s fast-paced financial landscape, High Net-Worth Individuals (HNIs) are constantly bombarded with product pitches and market “opportunities”. The fact is stark: the more noise you follow, the more complicated and vulnerable your portfolio is. At Privus, we believe that true strength lies in simplicity. A focused set of purposeful investments, aligned with long-term goals, forms the cornerstone of both wealth preservation and sustainable growth. Diversification is frequently misunderstood. It is not about adding more products or chasing every opportunity, it is about carefully combining assets that behave differently under varying market conditions. To illustrate, we analysed 3-year rolling returns over 20 years across Indian equities (NIFTY 50 TRI), US Equities (S&P 500 TRI), Gold, and 10-year Indian Government Bonds (G-Sec).

Source: Investing.com & NSE (Data as on 15th September 2025)

The correlation data highlights meaningful diversification benefits across asset classes. Gold (INR) continues to act as a hedge, with negative correlations to both S&P 500 (–40%) and S&P 500 TRI (INR) (–44%), highlighting its value during global equity drawdowns as well as INR weakness. NIFTY’s correlation with S&P 500 is modest at 25%, offering partial growth overlap but with diversification potential, while its link with S&P 500 TRI (INR) is even lower at –7%, reflecting the added role of currency. 10Y G-Secs remain broadly uncorrelated (2% to 11%) with equities and gold, underscoring their stabilizing role. As expected, S&P 500 and S&P 500 TRI (INR) are tightly aligned (91%), but currency translation meaningfully changes correlations for Indian investors. Together, this matrix highlights equities as compounding engines, gold as a hedge across both equity and currency risk, and bonds as portfolio anchors.

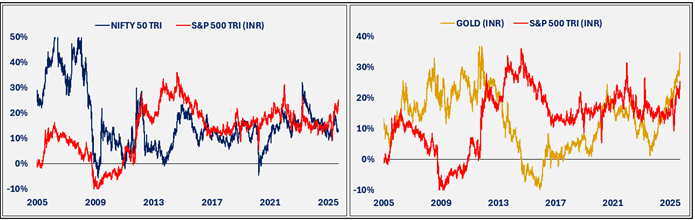

EQUITIES vs GOLD

Source: Investing.com & NSE (Data as on 15th September 2025)

The first chart compares NIFTY 50 and S&P 500, both equities but driven by different market cycles. The S&P 500 surged during the 2020–21 tech-led rally, while NIFTY picked up momentum in 2023–24 on strong domestic sentiment. With a moderate correlation of 25%, these two markets offer diversification benefits capturing global growth opportunities while reducing concentration risk.

At Privus, diversification is not about foreign exposure for its own sake, but about strategically allocating to non-overlapping sources of return.

The second chart shows Gold versus the S&P 500, where the negative correlation of –40% (–44% in INR terms) highlights their contrasting behaviour. While both can rise in short speculative bursts, gold consistently plays its role as a hedge, offsetting equity volatility and providing protection against both market drawdowns and INR depreciation.

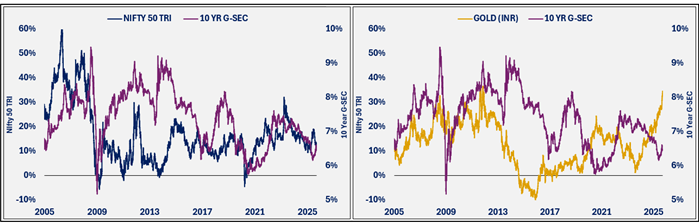

BOND vs GOLD vs NIFTY

Source: Investing.com & NSE (Data as on 15th September 2025)

While both Gold and bonds are considered “safe” assets, their behaviour differs significantly. Gold can be volatile and spike during global crises, while 10-year G-Secs offer slow but steady returns that are influenced by interest rate changes. Their correlation (6%) suggests that both can fortify the defensive aspect of a portfolio. This disparity is more apparent when compared with equities such as NIFTY, which respond rapidly to market fluctuations. At times of equity falling, G-Secs are normally stable, providing capital protection and stable returns. This trio of equity, gold, and bonds offers a strong blend of growth, protection, and capital preservation.

CONCLUSION:

These relationships underscore a simple truth: no single asset thrives in every market cycle. Equities drive long-term wealth creation, gold protects during systemic stress, and bonds anchor portfolios with stability and income. Diversification, when built carefully across uncorrelated or negatively correlated assets, reduces the need for projection and increases the chances of successful outcomes. For our clients, this means portfolios built to endure, not react.

In conclusion, real diversification isn’t having a bunch of products, but it’s the right mix with purpose. At Privus, we don’t sell products or chase trends. We craft strategies based on your goals, risk tolerance, and time horizon. Fewer, simpler investments, chosen deliberately and monitored with discipline, are the best platform for long-term success. If you seek focus, resilience, and control in your portfolio, we invite you to experience the Privus approach.

DISCLAIMER: This report/presentation is intended for the personal and private use of the recipient and is for private circulation only. It is not to be published, reproduced, distributed, or disclosed, whether wholly or in part, to any other person or entity without prior written consent. The report/presentation has been prepared by Privus Advisors (Firm) based on the information available in public domain & other external sources which are beyond Privus’ control and may also include the Firm’s personal views. Though the recipient recognizes such information to be generally reliable, the recipient acknowledges that inaccuracies may occur & that the Firm does not warrant the accuracy or suitability of the information. Neither does the information nor any opinion expressed constitute a legal opinion or an offer, or an invitation to make an offer, to buy or sell any financial or other products / services or securities or any kind of derivatives related to such securities. Any information contained herein relating to taxation is based on the information available in the public domain that may be subject to change. Investors/Clients should refer to relevant foreign exchange regulations / taxation / financial advice as applicable in India and/or abroad about the appropriateness and relevance / impact of the views or suggestions expressed herein, related to any Investment/Estate Planning / Succession Planning. All investments are subject to market risks, read all related documents carefully before investing. The Firm is registered with SEBI as a non-individual RIA bearing Reg. No. INA000019752 & BSEASL membership No. 2230. Registration granted by SEBI, membership of BASL and certification of National Institute of Securities Markets (NISM) in no way guarantees performance of the intermediary or provide any assurance of returns to investors.