Date: Oct 2025

For many successful professionals and business owners, the urge to prepay a home loan stems from financial discipline and the comfort of being debt-free. While this mindset is understandable, it is often not the most efficient use of capital from a wealth management perspective. At current interest rates, the numbers clearly favour maintaining the home loan and deploying surplus funds into equity markets instead. Here’s why:

Home loans in India run on a reducing balance. With each EMI, the principal shrinks, and interest is charged only on the outstanding balance. This ensures that the actual interest outgo is far lower than it appears when you look at the full tenure cost. In effect, you are paying interest on a diminishing base. However, when the amount is invested, it compounds from Day 1, creating wealth that grows much faster than the savings achieved by prepaying. In short, the gains from investing outweigh the savings from loan repayment.

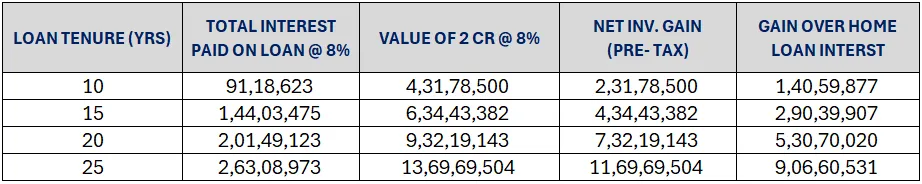

Chart below illustrates the incremental return one could make by investing the amount in an investment vehicle generating a similar return as the loan. Amount considered is INR 2.0 Cr and rate of interest at 8% throughout the tenure.

As seen above, while one pays a total interest of INR 91 Lakh on a 10-year loan, the potential gains from investing the loan amount in an asset earning similar to the loan rate would be INR 2.31 Cr, generating a net gain of INR 1.4 Cr. As tenure increases, the earnings increase substantially over interest paid on the loan.

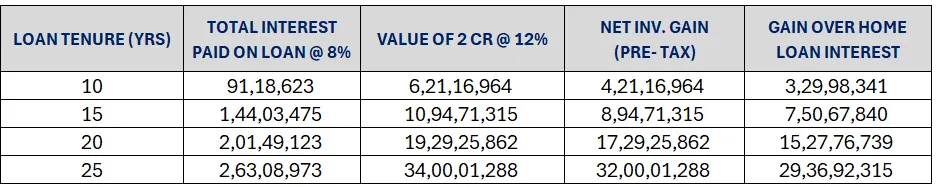

With home loan rates between 7-8%, equity portfolios over the long term can reasonably be expected to generate 12% or more. In 10 years the incremental over loan interest increases by more than 2x.

Equities tend to thrive when interest rates are low, as they are today (Mentioned in detail in our blog on the Inverse relationship between Nifty 50 PE and Repo rate). Over time, when interest rates rise and peak, equities often face valuation pressures. That is the point when it makes sense to reassess and consider prepaying part of the loan. Until then, your capital is better utilized in markets rather than locked away in an illiquid loan prepayment.

Rolling return analysis shows that as the holding period increases from 1 to 3 & 5 years, volatility in returns tends to reduce. Those that remain invested through market cycles will benefit from the long-term upward trend of the market and are less likely to be negatively impacted by temporary downturns

Repaying your loan early locks up capital. Keeping the loan while investing surplus funds allows you to stay liquid, diversified, and compounding. For high-net-worth individuals, where EMIs do not impact lifestyle, this approach maintains financial flexibility while accelerating wealth creation. For clients whose cash flows are strong and steady, repaying a home loan today is a sub-optimal allocation of capital.

When interest rates are low, the smarter strategy is to continue servicing the loan, while allowing your surplus funds to work harder in equities. Later, as interest rates climb, we can always pivot and consider partial repayment. Wealth creation is not about eliminating liabilities at the earliest opportunity – it’s about making every rupee work harder. And in the current environment, the math is unambiguous: let your loan run and let your capital compound. Ultimately, the right decision will also depend on your personal goals, risk appetite, and financial situation.

DISCLAIMER: This report/presentation is intended for the personal and private use of the recipient and is for private circulation only. It is not to be published, reproduced, distributed, or disclosed, whether wholly or in part, to any other person or entity without prior written consent. The report/presentation has been prepared by Privus Advisors (Firm) based on the information available in public domain & other external sources which are beyond Privus’ control and may also include the Firm’s personal views. Though the recipient recognizes such information to be generally reliable, the recipient acknowledges that inaccuracies may occur & that the Firm does not warrant the accuracy or suitability of the information. Neither does the information nor any opinion expressed constitute a legal opinion or an offer, or an invitation to make an offer, to buy or sell any financial or other products / services or securities or any kind of derivatives related to such securities. Any information contained herein relating to taxation is based on the information available in the public domain that may be subject to change. Investors/Clients should refer to relevant foreign exchange regulations / taxation / financial advice as applicable in India and/or abroad about the appropriateness and relevance / impact of the views or suggestions expressed herein, related to any Investment/Estate Planning / Succession Planning. All investments are subject to market risks, read all related documents carefully before investing. The Firm is registered with SEBI as a non-individual RIA bearing Reg. No. INA000019752 & BSEASL membership No. 2230. Registration granted by SEBI, membership of BASL and certification of National Institute of Securities Markets (NISM) in no way guarantees performance of the intermediary or provide any assurance of returns to investors.